None of those entities provide authorized, tax, or accounting recommendation. Investing companies in treasury accounts providing 6 month US Treasury Bills on the Public platform are by way of Jiko Securities, Inc. (“JSI”), a registered broker-dealer and member of FINRA & SIPC. See JSI’s FINRA BrokerCheck and Form CRS for additional information. JSI makes use of funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s worth at maturity). The worth of T-bills fluctuate and traders could obtain more or less than their authentic investments if offered prior to maturity. T-bills are subject to price change and availability – yield is topic to alter.

While the FDA has not removed phenylephrine from the us market, a minimal of one nationwide pharmacy, CVS, will no longer sell products that comprise phenylephrine as the only ingredient. Companies presented on OTC Markets Group are distinguished into 4 tiers in accordance with the available information. These tiers are created for the investors to supply information about businesses and the amount of revealed info.

Rules for behind-the-counter medicines typically vary by state or local regulation, and will include restrictions like age, proof of identification, or amount dispensed. Your pharmacist can inform you the specific laws for your state. Some merchandise, corresponding to pseudoephedrine (Sudafed), an oral decongestant which is topic to abuse, might require proper identification and a signature, or a prescription from your doctor, relying upon state laws.

How Do You Trade On Otc Markets?

This ends in them being unstable investments which might be often speculative in nature. Additionally, due to the nature of the OTC markets and the characteristics of the businesses that trade OTC, buyers should conduct thorough research before investing in these companies. The over-the-counter (OTC) market is a decentralized market the place what does otc shares, bonds, derivatives, currencies, and so forth are traded instantly between counterparties. While the OTC market provides prospects for traders to access a wide range of securities and for smaller companies to boost capital—many storied corporations have handed via the OTC market—it additionally comes with risks.

OTC markets are sometimes solid because the seedy underbelly of the inventory market. If the major exchanges are a mall, the OTC markets are a overseas https://www.xcritical.com/ bazaar. Plans are self-directed purchases of individually-selected belongings, which may embrace shares, ETFs and cryptocurrency.

These tiers are designed to provide traders insights into the amount of data that companies make available. Securities can move from one tier into one other based mostly on the frequency of economic disclosures. The tiers give no indication of the investment merits of the company and shouldn’t be construed as a suggestion. While the New York Stock Exchange (NYSE) and the Nasdaq get all of the press, over-the-counter markets, or OTC markets, listing more than eleven,000 securities throughout the globe for traders to trade. Impact on your credit score could differ, as credit score scores are independently decided by credit score bureaus primarily based on numerous components including the financial decisions you make with different financial providers organizations.

Benefits And Drawbacks Of Otc Markets

Apex Clearing and Public Investing obtain administrative charges for operating this program, which reduce the amount of curiosity paid on swept cash. Neither Public Investing nor any of its associates is a financial institution. Cryptocurrencies are not traded on the inventory market, and are sometimes exchanged instantly between sellers and patrons using electronic OTC trades. Bonds, including bonds bundled into ETFs, usually are not usually traded on centralized exchanges. Instead, most are exchanged OTC on the secondary market through broker-dealers. OTC Markets Group, a third get together, has created three tiers based mostly on the quality and amount of publicly available information.

Below is a table distinguishing the variations between buying and selling OTC and on a regulated change. Many of the investors buying and selling on the OTC markets are giant establishments such as mutual fund firms. However, particular person buyers also own lots of the low-priced OTC penny stocks. The OTC markets serve necessary functions for buying and selling bonds, ADRs, derivatives and shares of smaller corporations. But the added threat of buying and selling within the OTC markets is a consideration for any prudent investor.

What Is Otc? (over-the-counter) Definition Beginner’s Information

Before the establishment of formal exchanges, most securities were traded over-the-counter. As exchanges became extra prevalent in the late nineteenth and early 20th centuries, OTC buying and selling remained a major a half of the financial ecosystem. They have at all times had a status for where you find the dodgiest offers and enterprises, however may also find future profit-makers amongst them. The OTC Markets Group is an important a half of the OTC market.

Some states allow codeine-containing cough syrup, a schedule 5 managed substance, to be purchased from behind the counter, however most states require a prescription. These products, whereas thought of OTC, are saved behind the pharmacy counter and are allotted by a pharmacist. For instance, proton-pump inhibitors like esomeprazole (Nexium 24HR) and abdomen acid blockers like famotidine (Pepcid AC), both used for heartburn, are examples of products that have made the Rx-to-OTC switch. Nasonex 24HR Allergy, as nasal spray for symptoms due to hay fever grew to become obtainable OTC in 2022. The emergency contraceptive tablet («the morning-after capsule») known as Plan B One Step is now available OTC without age restriction and may be discovered on the cabinets in many pharmacies in the U.S.

Otcqb

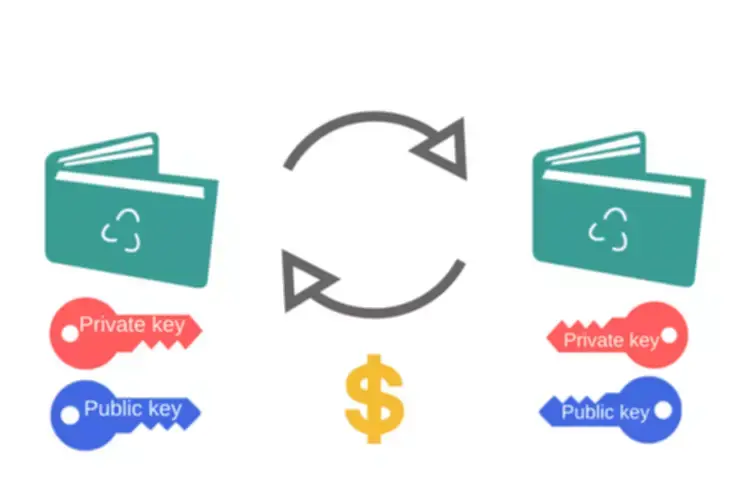

A decentralised market is solely a market construction consisting of varied technical devices. This construction allows traders to create a market with no central location. The opposite of OTC buying and selling is change trading, which takes place via a centralised exchange. Historically, the phrase trading over-the-counter referred to securities changing hands between two parties without the involvement of a stock trade. However, in the U.S., over-the-counter trading is now carried out on separate exchanges. Here’s a rundown of how the over-the-counter stock markets work and the forms of securities you would possibly find on the OTC markets.

FINRA also regulates the OTC Bulletin Board and OTC Link ATS. Those are methods through which broker-dealers submit worth and volume. Only broker-dealers certified with FINRA are allowed to apply to quote securities.

This made it unimaginable to determine a fixed stock value at any given time, impeding the power to trace worth changes and total market trends. These issues supplied obvious openings for much less scrupulous market participants. Another factor with OTC shares is that they are often quite unstable and unpredictable.

For foreign firms, cross-listing in OTC markets like the OTCQX can entice a broader base of U.S. buyers, potentially increasing trading volume and narrowing bid-ask spreads. Some overseas firms trade OTC to keep away from the stringent reporting and compliance requirements of listing on main U.S. exchanges. OTC markets, while regulated, typically have much less strict itemizing requirements, making them enticing for companies seeking to entry U.S. investors with out the burden of SEC registration for an exchange itemizing. OTC markets allow traders to commerce shares, bonds, derivatives, and other monetary devices instantly between two parties without the supervision of a proper exchange. This freewheeling format offers prospects but also pitfalls in contrast with exchange-based buying and selling.

Forms Of Otc Markets

OTC filing necessities vary by platform, however some firms on OTC markets may not need to file financial stories. When this occurs, the merchants may be large establishments in search of to make a large trade of hundreds of shares. The OTC platforms let them do that with out revealing their identities or having an impact on share costs. A listing on the Nasdaq will differ relying on entry and annual charges and market tier.

primarily based on previous efficiency do not a assure future efficiency, and prior to making any funding you must discuss your particular investment wants or search recommendation from a qualified professional. We are an impartial, advertising-supported comparison service.

What Is Over-the-counter Trading? An Investor’s Information To Otc Markets

We’ll explore the key OTC market sorts, the companies that are probably to trade on them, and the way these markets are evolving in today’s digital buying and selling environment. As with any funding determination, it’s necessary to fully contemplate the pros and cons of investing in unlisted securities. That’s why it’s nonetheless necessary to analysis the shares and companies as a lot as possible, thoroughly vetting the obtainable data.